5 and 10 Markers on Macroeconomic Objectives

With reference to Figure 2, explain one likely reason for the change in the Chile peso exchange rate between 2013 and 2015 (5)

An exchange rate is a way of comparing two or more currencies. This is done via FOREX, wherein the value of a currency is determined by how much it can buy another currency (i.e. how much one currency is worth when converted into another currency) (1). In 2013, the price of 100 Chile pesos was ~$0.2 (1), and in 2015, that had fallen to ~$0.16 (1). One reason for this fall (and the weakening of the Chile pesos against the dollar) could be because of inflation increasing. One consequence of a rising rate of inflation is usually a shift in AD, to the right. This could be because of the inflationary pressures that come from an increase in consumption across the economy - which is known as 'demand pull inflation' (1). As demand for goods and services increases across the economy, inflationary pressures rise because firms are more likely to increase their prices to ration demand. Moreover, this links to the exchange rate because, when the value of a currency falls, exports become cheaper (because they are more competitive), and imports become more expensive, increasing net trade, and thereby shifting AD to the right from the sum of its components: C+I+G+(X-M) (1). Thus, in the case of the Chilean economy, inflation could've risen, thereby increasing AD, and therefore weakening the Chilean pesos against the US dollar.

Secure Level 2, 5/5 ✅

Assess the likely impact of falling real incomes on UK consumers (4)

Real incomes are incomes accounted for by inflation. Real incomes may fall if inflation is higher than the wage increases of UK consumers, or if a fall in aggregate demand results in firms reducing the wages of workers. One impact of this may be a decrease in consumption. This is because, as the economy faces a recession, the economy will be in a negative output gap and thus will have spare capacity. This is because demand will fall - as firms supply will exceed demand. To combat this, firms may reduce the wages of workers (in a classical theory) - which may in turn result in a wage reduction spiral, where demand will fall even further down as people have even less disposable incomes on average. This can be indicated by the fall in real incomes during the 2008/2009 financial crisis, wherein real incomes fell from ~£680 to ~£640. As real incomes fall, this may result in wage.

With reference to the data, explain two likely reasons for the UK’s falling inflation rate (10)

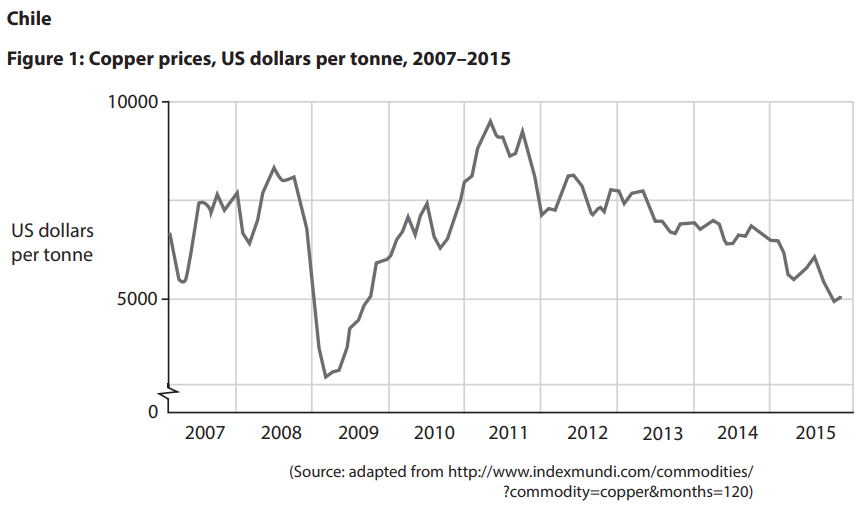

One reason for the UK’s falling inflation rate may be a fall in aggregate demand. This is because, as aggregate demand falls, inflationary pressures decreases. This can be indicated by a fall in consumption for example. When consumption decreases, aggregate demand falls as there’s more spare capacity - in shops for example. Thus, this results in a negative output gap in the economy, as firms have less incentive to produce goods as their supply exceeds the total demand at the given price level. Therefore, suppliers have more incentive to reduce the prices of their goods and services to incentivise demand - or rather, keep the prices where they are at. As a result of this, inflation may fall as a result, as on the contrary to a rise in aggregate demand, wherein consumption may increase and where inflationary pressures will rise, when AD falls as a result of a reduction in demand, demand-side disinflation may occur. This can be indicated by figure 1, wherein real income fell from 2011 to 2012, from ~£620 to ~£610, and consequently, inflation fell from 4% to 3.5%.

Nevertheless, this may be an overly dystopian portrayal of falling inflation (disinflation). This is because, as the rate of inflation falls, the Bank of England imposes a contractionary monetary policy wherein “interest rates will go as low a they can go”. Thus, in the short term, consumption may stay at a low level as a result of a decreasing inflation rate, but over the long run, it may “bounce back” as interests rates fall to incentive consumption (injections) and decentivise savings (withdrawals).

Moreover, another reason for the UK’s falling inflation rate may be a fall in the long-run aggregate supply of the UK economy. This is because the costs suppliers may face may decrease in the long run may fall (cost-push inflation falls). This may be because of technological developments in the economy (such as AI), wherein, as a result, productivity may increase, which may reduce the time needed to produce a good or service per unit. Therefore, the costs suppliers may face may decrease - like in Oct 2011-Jul 2012, where inflation fell from 5% to 2% - as less time spent per good/service means they can spend less time making the same amount of goods and services (reducing employee costs for example, as hours are reduced). Therefore, some employees may be fired as a result, as they are not needed as productivity increases as a result of technological developments like AI automation (thus decreasing LRAS). This may result in a falling rate of UK inflation as the economy will no longer be at full employment as more people are unemployed; therefore, this may decrease the average rate of consumption as the average disposable incomes of UK consumers may increase. Therefore, this may result in a wage reduction spiral, wherein demand falls, and wherein, to combat this (i.e. to combat supply exceeding demand), prices also fall - inducing another period of disinflation.

Nevertheless, this may be an overly dystopian view. This is because, in the Keynesian viewpoint of the economy, there are rights for UK workers such as fair dismissal - wherein trade unions can enforce this. As a result, UK firms cannot just ‘fire’ employees if they are no longer needed, as dismissal needs to be fair, especially as trade unions can strike back to combat managers animal spirit’s resulting in them firing employees. Thus, this may not result in a period of disinflation.